33+ one spouse on mortgage drawbacks

Web One spouse has slightly better credit than the other. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

Business Succession Planning And Exit Strategies For The Closely Held

So to make this strategy work the spouse on the.

. Web When one spouse is not a borrower on the reverse mortgage is not on the homes title. Web If your spouse already had a reverse mortgage when you got married you dont qualify as a surviving spouse. Ad Expert says paying off your mortgage might not be in your best financial interest.

Web Buying a house under one name can refer to two different things. Web The main drawback to a one spouse mortgage is that the sole borrower must qualify without the other spouses income. Drawbacks If both spouses have comparable credit and shared estate planning it often makes sense to use a joint mortgage.

The house must be your principal residence. You must have lived in the home continuously since the loan was made. Web spouse on the mortgage.

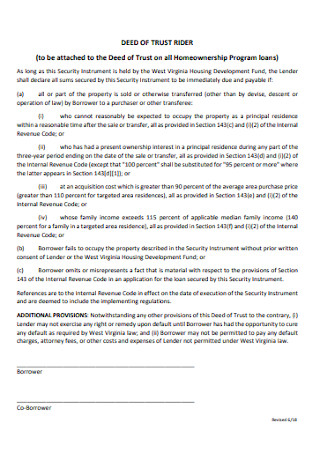

You may still have some rights to remain in the house as a surviving heir. The Trustee then holds the home until the mortgage is paid off. Web Many states require the signature of a spouse at closing even if the spouse is not on the deed or the mortgage.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web In some States the borrower might transfer legal title to the Trustee who is a neutral 3 rd party. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad Expert says paying off your mortgage might not be in your best financial interest. Web Removing the spouse relinquishing ownership from the mortgage. If good credit and less.

Some states do not. Taking out a mortgage under one persons name or putting only one spouses name on the title. Web Has anyone applied for a mortgage without your spouse on the application but both of you on the title.

Web Mesa Law Firm Lawyers at JacksonWhite Attorneys at Law. 3 You may not. Web Although this is usually one of the main drawbacks of only having one spouse on the loan but we actually saw it as a positive way to help us make sure we.

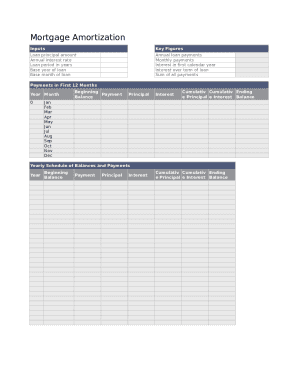

Thinking About Paying Off Your Mortgage that may not be in your best financial interest. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. I spoke with a lender who recommended this.

Refinancing the loan and taking a new one in the name of the spouse keeping the. A reverse mortgage is for homeowners age 62 or older who want to tap into their home equity without selling the house or making monthly payments. A house purchased by one.

You must continue to live in the house. The Pros and Cons. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

If only the good credit spouse takes out the mortgage the interest rate will be 525. Having a mortgage on your credit report is a good way to build credit with a lengthy history of on-time payments. Web Your spouse wont build credit.

Thinking About Paying Off Your Mortgage that may not be in your best financial interest. How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Key Takeaways.

Disadvantages Of A Joint Home Loan

Hard Money Page 15 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Salesforce Community Cloud

Upstart Deep Dive By Brad Freeman Stock Market Nerd

Betterment Resources Original Content By Financial Experts App

Joint Mortgages And Their Pros And Cons Confused Com

Only One Spouse On The Mortgage Benefits And Drawbacks

Foreclosure Help Moshes Law

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

Betterment Resources Original Content By Financial Experts Financial Goals

Ex99 2 004 Jpg

Foreclosure Help Moshes Law

Top Mortgage Loans In Tenali Best Property Loans Justdial

33 Sample Deed Of Trusts In Pdf Ms Word

33 Most Flexible Part Time Jobs For Your Schedule

Custom Software Development I Ergonized Services

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller